how to claim eic on taxes

You could be banned from claiming. Millions of older Americans will be able to claim an earned income tax credit EITC when they file their 2021 tax returns this year and Lisa Marsh Ryerson AARP.

Earned Income Tax Credit Tax Graph Income Tax Tax Credits Income

E-File directly to the IRS.

. The Earned Income Tax Credit EITC is the countrys largest. To claim the Earned Income Credit for last year you must amend your return by filing Form 1040X by the later of these dates. Download or Email 1040 SEI More Fillable Forms Register and Subscribe Now.

If you qualify you can use the credit to reduce the taxes you owe. Connect With An Expert For Unlimited Advice. Then your income has to be within stated limits.

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. Basic Qualifying Rules. How to Claim the Earned Income Tax Credit EITC Your Refund.

First you have to qualify. By law the IRS cannot issue EITC and ACTC refunds. 16 hours agoLearn more about the Earned Income Tax Credit and how taxpayers can meet the IRS requirements to claim it.

Ad Our Experts Will Make You Confident Your Taxes Are Done Right Guaranteed. To claim the EITC taxpayers need to file a Form 1040. Have investment income below 10000 in the tax year 2021.

Keep in mind this is one of the few refundable credits meaning that if you have more credit than taxes. Connect With An Expert For Unlimited Advice. If you claim the EITC your refund may be delayed.

If the taxpayer is claiming the EITC with a qualifying child they must also complete and attach the Schedule EIC to the tax return. Have worked and earned income under 57414. Finally if you have one or more kids they have to qualify too for you to receive a larger credit.

Ad Guaranteed maximum refund. Ad Receive you refund via direct deposit. On the other hand this tax season the Earned Income Credit is worth as much as 6660 for families with 3 or more eligible children.

Three years from the due date of your original. Ad Receive you refund via direct deposit. Please log into the account and follow these steps.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You might need to file Form 8862 Information to Claim Earned Income Credit After Disallowance before you can claim the EIC again. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current. Dont Know How To Start Filing Your Taxes. Senior research associate at the Urban.

You will need to attach a Schedule EIC to the. How to Claim the Earned Income Credit You must claim the Earned Income Credit with your Federal Individual Income Tax Return. To qualify for the EITC you must.

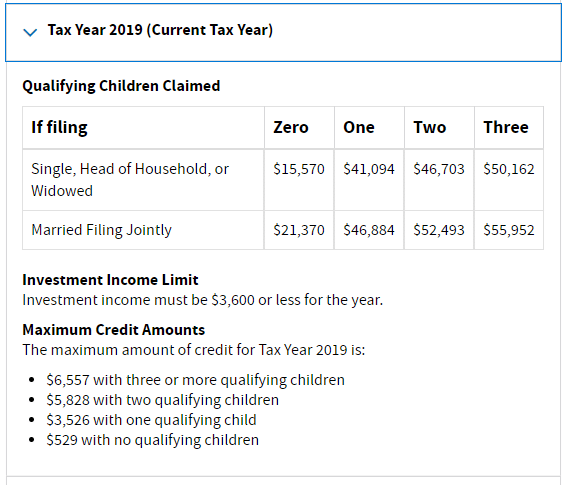

Check the box indicating Your Name wishes to elect to use. Dont Know How To Start Filing Your Taxes. If you qualify for the earned income credit or EIC this is how much of a tax credit you get.

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

Benefits Of The Earned Income Tax Credit Eitc